Consumers Bancorp, Inc. Reports Earnings Q2 2021

Consumers Bancorp, Inc. Reports:

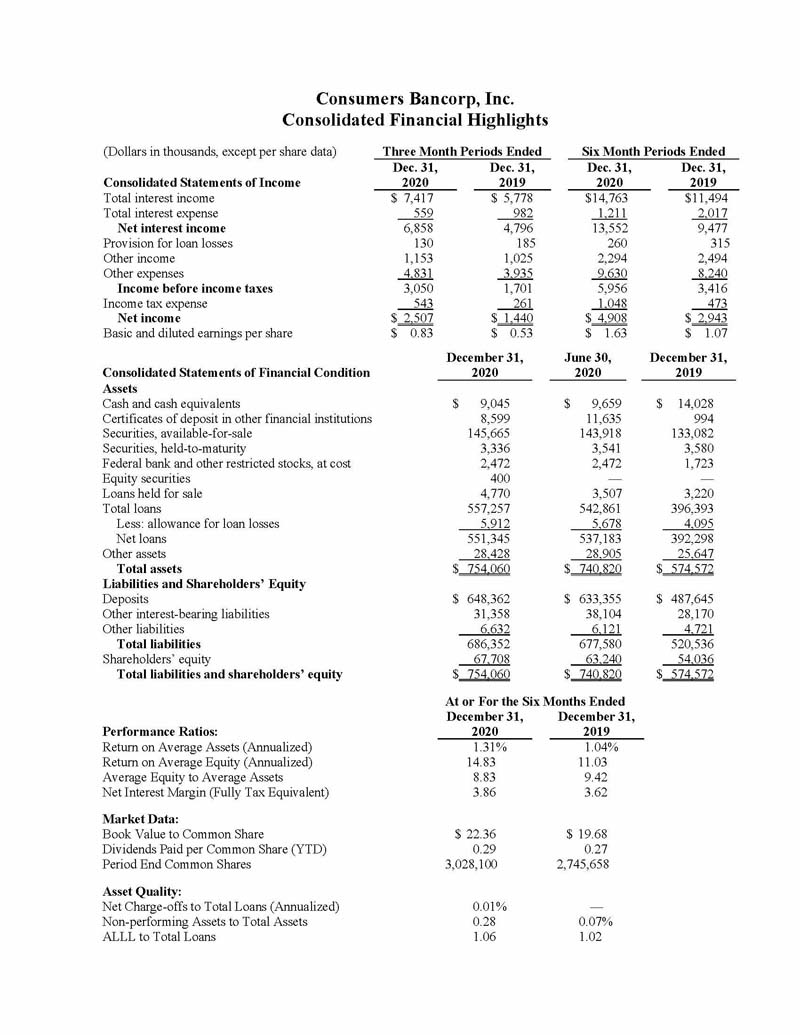

- Net income increased to $2.5 million, or 74.1%, for the three-month period ended December 31, 2020 compared with the same period last year

- An annualized return on average equity of 14.92% and an annualized return on average assets of 1.33% for the second quarter of fiscal year 2021

- Total loans increased by $14.4 million, or an annualized 5.3%, for the three-month period ended December 31, 2020

- Non-performing loans to total loans of 0.37% at December 31, 2020

Minerva, Ohio—January 20, 2021 (OTCQX: CBKM) Consumers Bancorp, Inc. (Consumers) today reported net income of $2.5 million for the second quarter of fiscal year 2021, an increase of $1.1 million, or 74.1%, from the same period last year. Earnings per share for the second quarter of fiscal year 2021 were $0.83 compared to $0.53 for the same period last year. Net income for the three months ended December 31, 2020 was positively impacted by a $2.1 million, or 43.0%, increase in net interest income, which was primarily the result of a $182.9 million increase in average interest-earning assets from the same prior year period. The increase in average interest-earning assets was primarily a result of the merger with Peoples Bancorp of Mt. Pleasant, Inc. (Peoples), which closed on January 1, 2020, and from the addition of Small Business Administration’s (SBA) Paycheck Protection Program (PPP) loans.

“Quarterly earnings were again positively impacted by residential mortgage income, loan growth, and the bank’s participation in the Paycheck Protection Program. The strong housing market and low interest rates continue to drive high residential purchase, construction, and refinance activity. While we have very few borrowers currently in payment deferral status, we experienced a slight increase in consumer delinquency at quarter-end, which is partially attributable to delays in December mail delivery caused by the holidays and the pandemic,” said Ralph J. Lober II, President and Chief Executive Officer. He continued with, “We continue to contribute to the economic recovery by participating in the second round of the SBA’s PPP loan program. Demand for the program is strong and we began submitting applications to the SBA on January 15th. As of January 15, 2021, approximately 28% of the $68.7 million the bank advanced during the first round of PPP advances have been forgiven by the SBA. We continue to work with our customers to help them obtain SBA forgiveness on round one advances and secure advances in round-two of the program.”

Operating Results Overview

Net income increased to $2.5 million, or $0.83 per share, for the three months ended December 31, 2020 compared to $1.4 million, or $0.53 per share, in 2019.

Net interest income increased by $2.1 million, or 43.0%, for the three months ended December 31, 2020 compared to the same period last year, with interest income increasing by $1.6 million and interest expense decreasing by $0.4 million. The increase in interest income was primarily the result of a $182.9 million increase in average interest-earning assets from the 2020 fiscal year as a result of the merger with Peoples and from the origination of PPP loans, which had an average balance of $61.6 million in the second quarter of fiscal year 2021. The PPP loans resulted in $2.4 million of SBA origination fees that are being accreted into interest income over the life of the loans. During the quarter ended December 31, 2020, $912 thousand of interest and fee income was recognized related to the PPP loans. The net interest margin was 3.87% for the quarter ended December 31, 2020, 3.84% for the quarter ended September 30, 2020, and 3.62% for the quarter ended December 31, 2019. The yield on average interest-earning assets was 4.18% for the quarter ended December 31, 2020 compared with 4.35% for the same prior year period. The cost of funds decreased to 0.46% for the quarter ended December 31, 2020 from 1.02% for the same prior year period.

The provision for loan losses was $130 thousand for the three-month period ended December 31, 2020 compared with $185 thousand for the same period last year. Net recoveries of $16 thousand were recorded for the three-month period ended December 31, 2020.

Other income increased by $128 thousand for the three-month period ended December 31, 2020 compared to the same prior year period. For the three-month period ended December 31, 2020, gains from the sale of mortgage loans increased by $104 thousand, or 73.2%, and debit card interchange income increased by $61 thousand, or 15.9%, from the same prior year period. These increases were partially offset by a decline of $46 thousand, or 12.8%, in service charges on deposit accounts primarily due to a decline in overdraft charges as the COVID-19 pandemic dramatically impacted consumer spending habits.

Other expenses increased by $896 thousand, or 22.8%, for the three-month period ended December 31, 2020 compared to the same prior year period. Other expenses for the three-month period ended December 31, 2020 include expenses associated with the three new office locations and additional staff gained as a result of the merger with Peoples that closed on January 1, 2020. In addition, incentive accruals and mortgage commissions also increased during the second quarter of fiscal year 2021. Professional fees of $59 thousand associated with the announced planned purchase of two branch locations in Columbiana County, Ohio were recognized during the three-month period ended December 31, 2020.

Year-to-Date Operating Results Overview

Net income increased to $4.9 million, or $1.63 per share, for the six months ended December 31, 2020 compared to $2.9 million, or $1.07 per share, for the six months ended December 31, 2019.

Net interest income for the six months ended December 31, 2020 increased by $4.1 million compared to the same period last year, with interest income increasing by $3.3 million and interest expense decreasing by $0.8 million. The increase in interest income was primarily the result of a $182.3 million increase in average interest-earning assets from the 2020 fiscal year. The increase in average interest-earning assets was primarily a result of the addition of PPP loans, the merger with Peoples and organic growth.

The net interest margin was 3.86% for the 2021 fiscal year and 3.62% for the 2020 fiscal year. Consumers’ yield on average interest-earning assets was 4.20% for the current fiscal year compared with 4.38% for the prior fiscal year. Consumers’ cost of funds decreased to 0.50% for the current fiscal year from 1.05% for the prior fiscal year. PPP loans had an average balance of $64.9 million for the six-month period ended December 31, 2020 with a total of $1.8 million of interest and fee income recognized during the six-month period ended December 31, 2020.

The provision for loan losses decreased by $55 thousand to $260 thousand for the six-month period ended December 31, 2020 compared with $315 thousand for the same prior year period. Net charge-offs of $26 thousand, or 0.01% of total loans, were recorded for the six-month period ended December 31, 2020.

Other income decreased by $200 thousand, or 8.0%, for the six-month period ended December 31, 2020 compared to the same prior year period. Other income for the six-month period ended December 31, 2019 includes $324 thousand of income recognized as a result of proceeds received from a bank owned life insurance policy claim and a $110 thousand gain on sale of securities. For the six-month period ended December 31, 2020, gains from the sale of mortgage loans increased by $205 thousand, or 74.0%, and debit card interchange income increased by $126 thousand, or 16.3%, from the same prior year period. These increases were partially offset by a decline of $112 thousand, or 15.3%, in service charges on deposit accounts primarily due to a decline in overdraft charges as the COVID-19 pandemic dramatically impacted consumer spending habits.

Other expenses increased by $1.4 million, or 16.9%, for the six-month period ended December 31, 2020 compared to the same prior year period. The 2021 fiscal year includes six months of expenses associated with the three new office locations and additional staff gained as a result of the merger with Peoples that were not included in the prior year period. In addition, incentive accruals and mortgage commissions also increased during the 2021 fiscal year.

Balance Sheet and Asset Quality Overview

Assets as of December 31, 2020 totaled $754.1 million, an increase of $13.2 million, or an annualized 3.5%, from June 30, 2020. From June 30, 2020, total loans increased by $14.4 million, or an annualized 5.3%, and total deposits increased by $15.0 million, or an annualized 4.7%.

Non-performing loans were $2.1 million as of December 31, 2020 and $1.2 million as of June 30, 2020. The allowance for loan and lease losses (ALLL) as a percent of total loans at December 31, 2020 was 1.06% and net charge-offs of $26 thousand were recorded for the six-month period ended December 31, 2020 compared with an ALLL to loans ratio of 1.05% at June 30, 2020 and net charge-offs of $8 thousand for the six-month period ended December 31, 2019. As of December 31, 2020, approximately 18 borrowers with an outstanding balance of $667 thousand continued to receive payment assistance through the loan modification program that offered principal and interest payment deferrals for a maximum period of up to 180 days.

Consumers provides a complete range of banking and other investment services to businesses and clients through its eighteen full-service locations and one loan production office in Carroll, Columbiana, Jefferson, Stark, Summit and Wayne counties in Ohio. Information about Consumers National Bank can be accessed on the internet at http://www.consumersbank.com.

Forward-Looking Information

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). The words “may,” “continue,” “estimate,” “intend,” “plan,” “seek,” “will,” “believe,” “project,” “expect,” “anticipate” and similar expressions are intended to identify forward-looking statements. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future plans, objectives and strategies of Consumers. These statements are subject to inherent risks and uncertainties that could cause actual results to differ materially from those anticipated at the date of this press release. The COVID-19 pandemic is affecting us, our customers, employees, and third-party service providers, and the ultimate extent of the impact on our business, financial position, results of operations, liquidity, and prospects is uncertain. Other risks and uncertainties that could adversely affect Consumers include, but are not limited to, the following: regional and national economic conditions becoming less favorable than expected, resulting in, among other things, high unemployment rates, a deterioration in credit quality of assets and the underlying value of collateral could prove to be less valuable than otherwise assumed or debtors being unable to meet their obligations; rapid fluctuations in market interest rates could result in changes in fair market valuations and net interest income; pricing and liquidity pressures that may result; material unforeseen changes in the financial condition or results of Consumers National Bank’s (Consumers’ wholly-owned bank subsidiary) customers; unanticipated difficulties or expenditures relating to the merger? legal proceedings, including those that may be instituted against Consumers, its board of directors, its executive officers and others? any failure to meet expected cost savings, synergies and other financial and strategic benefits in connection with the merger within anticipated time frames or at all; the response of customers, suppliers and business partners to the merger? competitive pressures on product pricing and services; the economic impact from the oil and gas activity in the region could be less than expected or the timeline for development could be longer than anticipated; and the nature, extent, and timing of government and regulatory actions. While the list of factors presented here is, and the Risk Factors starting on page 16 of the registration statement on Form S-4/A filed with the SEC on September 4, 2019 related to the merger of Consumers/Peoples, are considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. The forward-looking statements included in this press release speak only as of the date made and Consumers does not undertake a duty to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.